How to Upload Live Bloomberg Portfolio Into Excel

Introduction to Bloomberg Excel add-in

Access Bloomberg majority data via Excel

Many of the functions found in the Bloomberg terminal can also be accessed directly from Excel if yous install the Bloomberg Excel add-in. This method can be much more efficient when yous demand access to majority data, but can be a trivial unintuitive. Here are five means to get you started.

- Installing the add-in

- Ways of getting data from Bloomberg to Excel

- Browsing and using templates

- Import data with a wizard

- Using the part builder

Note : Please come up to the Eddie Davies Finance Zone to use Bloomberg. During 2020–21, Bloomberg is also available remotely. A detailed footstep-by-pace guide on how to access this is available via the Library website . When logging into Bloomberg Anywhere, make certain to choose ' Launch with the Bloomberg Excel add-in '. Ignore Part i of this page.

i. Installing the add-in

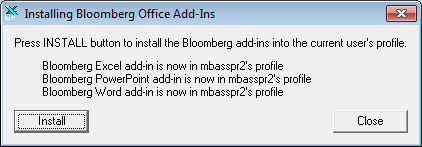

To install:

- Shut Excel and click: 'Start > All Programs > Bloomberg > Install Function Add-ins'.

- A window volition appear, click 'Install'.

- The side by side window shows the installation status of the Bloomberg add-in for Excel, PowerPoint and Give-and-take.

- If this process does non work commencement fourth dimension; effort opening and endmost Excel and repeating the above steps.

- (If this procedure still does not work, we may need to run the Bloomberg API Environment Diagnostics tool. Contact the Library for support.)

Note: You lot will need to repeat this procedure each time you log onto a Bloomberg PC.

For assistance with using the Excel add-in, including templates, use the final with the Excel template function 'XLTP<GO>'.

^ back to contents

two. Means of getting data from Bloomberg to Excel

At that place are various means to become data from the Bloomberg concluding into Excel (remember to work at the terminal though).

- Top-left Fiscal analysis (FA): 'Red menu > Output > Excel > Current Template' (data is live).

- Summit-right Price charts (GP): 'Right-click on chart > Copy/Export Options > Copy Data to Clipboard' (then paste in Excel).

- Bottom-left Member weights (MEMB): 'Ruby-red menu > Output > Excel' (information is fixed).

- Lesser-correct Historical alphabetize member changes (CHNG): Non possible to export report data.

Await for commands such as 'Copy data to clipboard', 'Output > Excel' or similar, by clicking on the red menu bar (Actions) or right-clicking on charts or data.

Sometimes the action will download and open up a new Excel document; the information volition either be written in directly or load subsequently via the Bloomberg API. Sometimes the information is copied to the clipboard for y'all to paste into a worksheet of your option.

Notation: A sheet which contains Bloomberg formulas creating live data may not load on a PC without Bloomberg unless you relieve as CSV or re-create/paste-as-values. (This is also truthful for all the Excel options below.)

^ back to contents

iii. Browsing and using templates

Templates are most useful if yous are looking upward ane company, bond, exchange rate or commodity. Each template will requite you lot a detailed Excel workbook filled with data and visualisations that are updated live from Bloomberg via the Excel API. Bister coloured fields are editable, frequently to change the company, country, sector, appointment or other variable.

The templates can be found in the terminal with the XLTP<GO> office, and in Excel via 'Bloomberg > Explore > Template Library'. They are grouped into market areas such equally commodities, equities and credit.

^ back to contents

4. Import information with a wizard

Delight note: the Import Data wizard has been replaced with the Spreadsheet Builder wizard.

The Spreadsheet Builder wizard will let you type security identifiers or select from a common index, then choose your data types and data range. It will so produce the results starting in the cell y'all selected. Follow the steps below to utilize the wizard to select historical end-of-mean solar day prices for a option of companies.

- Open Excel. In the Bloomberg tab, click the 'Spreadsheet Builder' icon, select the pick 'Historical Information Table' and click 'Next'.

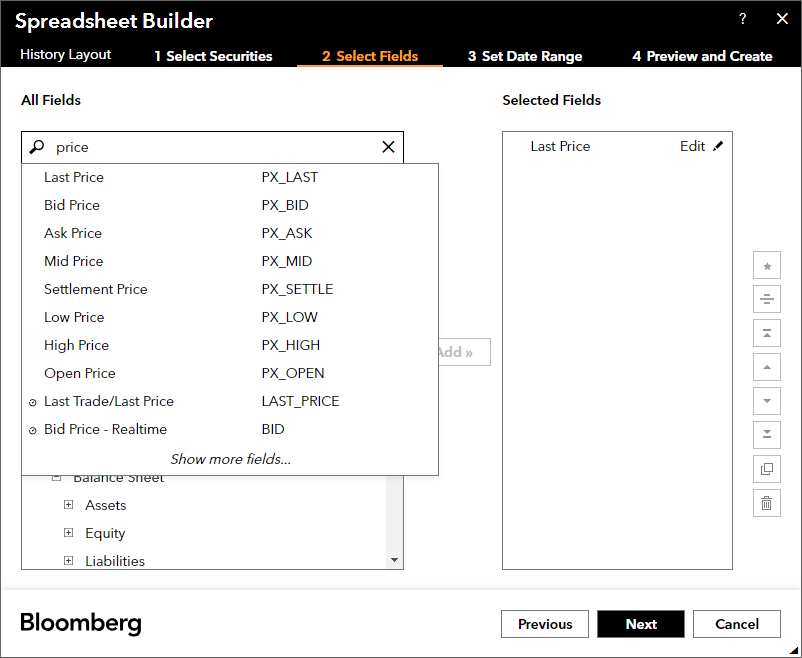

- The Spreadsheet Builder has 4 pages: '1 Select Securities', '2 Select Fields', '3 Set Date Range', 'iv Preview and Create'.

- In folio i, you can type the names of securities you wish to written report in the search box on the left, or choose from a listing. To select all companies in the FTSE 100, click on 'Equity Index', scroll downward then double-click on 'UKX'. With all your selected securities appearing on the right, click 'Next' to continue.

- In page 2, you can select fields in the same way as securities. In the search box, type 'toll' and select 'Terminal Price', and then blazon 'volume' and select 'Volume'. Click 'Adjacent' to go on.

- In folio 3, you can select the beginning date, terminate engagement, and periodicity (frequency). In Bloomberg, dates appear in the format MM/DD/YYYY; in Excel, they appear in your local format, which is DD/MM/YYYY in the United kingdom. Continue the default options and click 'Next' to continue.

- In folio four, you lot tin can modify the layout options and group for your console data. You tin choose to 'Transpose Axes' or 'Group past Field', for example, or choose to show 'Only Start Security' if you lot are experimenting with your layout earlier downloading a big corporeality of data. This time, just click 'Cease'.

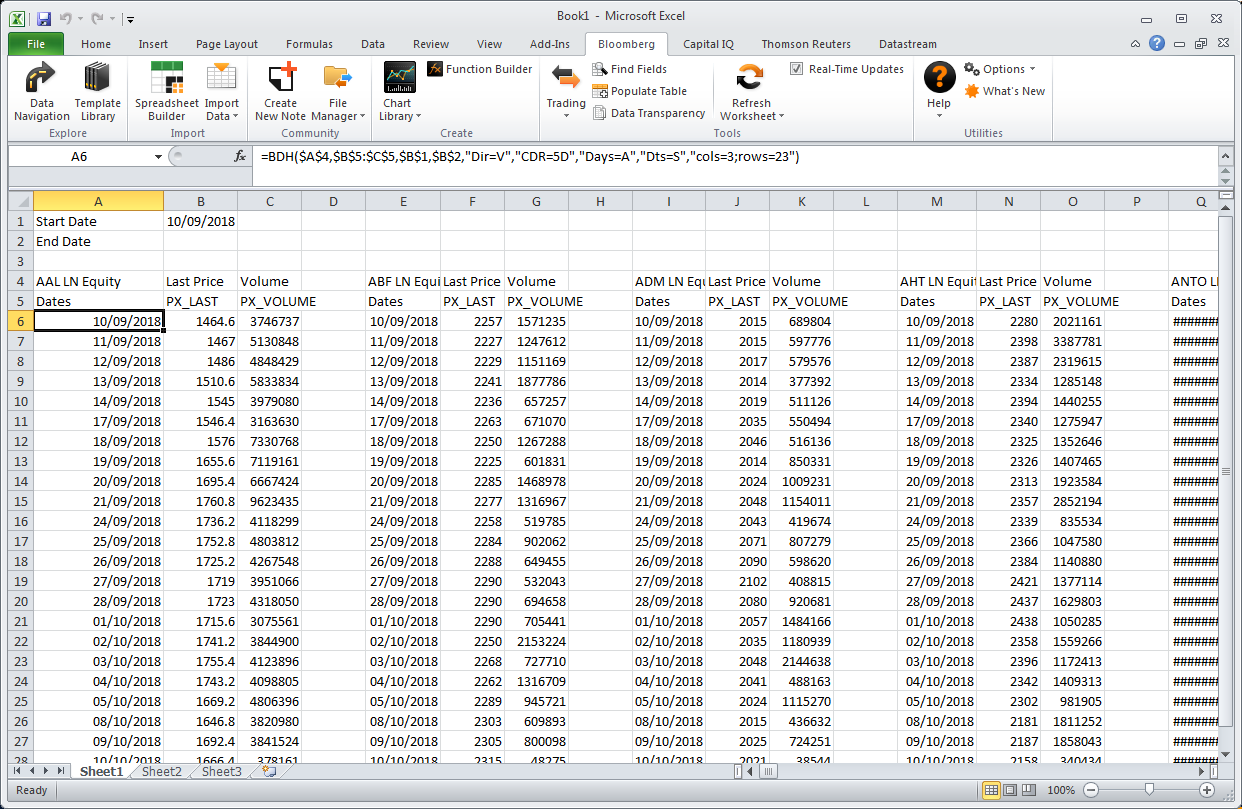

- The data is downloaded to a unmarried Excel sheet. The formula to download the data is included, in example you lot wish to make a modification and download once more.

^ back to contents

5. Using the function builder

If you want a little more control, use the office builder, found in 'Bloomberg > Create > Office Builder'. This more advanced tool will expose the Bloomberg API to you, where a user interface exercise the difficult work to create functions for you, such equally =BDP("AAPL The states EQUITY", "INDUSTRY_SECTOR") producing the value 'Technology'.

The function builder volition outset by asking yous to cull i of three major Bloomberg Functions:

- BDP: (Bloomberg Data Point) imports a single information point of electric current data.

- BDH: (Bloomberg Information History) returns the historical data for a selected security.

- BDS: (Bloomberg Data Serial) imports a set of bulk data such as peers.

For your chosen function, y'all will be asked to blazon in a security (such as AAPL US Disinterestedness), a field (such as INDUSTRY_SECTOR or PX_LAST) , and dates (depending on the function). The tool will suggest auto-completion if y'all don't happen to know the exact security or field lawmaking. It will merely propose valid responses.

You tin can add optional extra parameters such as orientation=H|V, currency, or array=True which puts all the output data into one cell instead many rows/columns (requires array formulas afterwards). Note that row and column counts will be added as extra parameters automatically subsequently the formula has chosen.

The security, field and dates tin can be written into the formula or referenced from other cells.

Discover that the security ID needs to end with what kind of entity it is, so equities finish EQUITY, bonds end CORP etc.

Can I custom-build some formulas?

Yes, see our old blog post Advanced support for using the Bloomberg Excel add together-in for more than details on edifice formulas, using Python scripting to assist big queries and using R to automate the process.

^ back to contents

Source: https://medium.com/specialist-library-support/introduction-to-bloomberg-excel-add-in-4a93dafe013c

0 Response to "How to Upload Live Bloomberg Portfolio Into Excel"

Post a Comment